EY released its 2024 Luxembourg Attractiveness Survey on 13 June 2024. The study examines foreign direct investment (FDI) in Europe and Luxembourg, as well as how (potential) investors perceive the country’s competitiveness. The professional services network EY surveyed 150 C-suite executives, with around half already having operations in Luxembourg.

EY released its 2024 Luxembourg Attractiveness Survey on 13 June 2024. The study examines foreign direct investment (FDI) in Europe and Luxembourg, as well as how (potential) investors perceive the country’s competitiveness. The professional services network EY surveyed 150 C-suite executives, with around half already having operations in Luxembourg.

“Attractiveness and competitiveness is key for Luxemburg and Europe,” emphasises Prime Minister Luc Frieden at the launch of the survey. “We will work hard in my government to make sure that will continue to be the case. Our goal is to make sure that Luxembourg remains the place to be, to live, to work and to do business for the years to come.”

#1 for FDI per capita

For the third consecutive year, Luxembourg ranked first in the total FDI projects per capita, with 5.67 projects per 100,000 people. It is followed by Cyprus, Portugal, Ireland, and Belgium. France and the UK, despite larger populations, rank sixth and seventh.

Belgium emerged as the largest contributor of FDI projects in Luxembourg (25%), followed by the United States (22%) and the United Kingdom (17%).

Luxembourg’s overall ranking improves marginally

Luxembourg’s overall ranking improves marginally

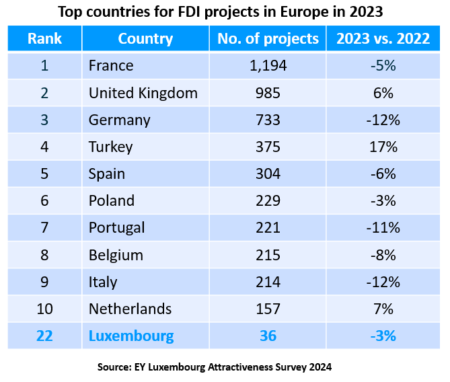

FDI in Europe dropped by 4% in 2023, with 5,694 projects announced, down from 5,962 projects in 2022. “A combination of factors contributed to the slowdown in international investments: suboptimal economic growth, soaring inflation and related interest rates, escalating global geopolitical conflicts, and continuously high energy costs,” the report notes.

This slowdown, however, follows two consecutive years of an upward trend.

France, the United Kingdom, and Germany lead in terms of FDI projects, accounting for more than half (51%) of Europe’s total. Luxembourg saw a 3% decrease in FDI projects (from 37 in 2022 to 36 in 2023), but its overall ranking improved from 23rd to 22nd.

Surge in investor interest (72%)

Luxembourg has been able to capture the attention of an increasing number of investors. In fact, its attractiveness to investors is at an all-time high, with 72% (up from 46% in the previous survey) of executives planning to invest at some point during the next 12 months. Additionally, 60% of investors believe Luxembourg’s attractiveness will increase during the next three years. In the meantime, transforming this enthusiasm into concrete projects is key.

Olivier Coekelbergs, Country Managing Partner at EY Luxembourg states: “Luxembourg now stands before a prime opportunity to harness this investor optimism. The government’s comprehensive national plan, which addresses a spectrum of pertinent issues, demands swift and strategic implementation. We are already witnessing the rollout of several measures.”

Investment prospects

Executives planning to establish operations in Luxembourg are targeting diverse activities: business support services (53%), training centres (40%), sales and marketing offices (39%), R&D (34%), supply chain and logistics (16%), manufacturing (15%), and headquarters (15%).

Among those seeking to expand operations, 58% plan to grow sales and marketing offices, 48% business support services, 41% aim to expand R&D activities, 32% intend to set up training centers, 28% supply chain and logistics, 24% wish to expand HQ activity in Luxembourg, and 19% manufacturing.

Top sectors for FDI

According to the report, the three main sectors for FDI in Luxembourg currently are: Finance (28%), & professional services (22%), and software/digital & IT services (14%). In terms of activities, business services projects account for 44%, followed by manufacturing (14%) and headquarters (14%).

The survey mentions that investors choose to establish or develop in Luxembourg for a variety of reasons, including the huge number of international players and the potential for synergies between global and European operations. In less than one year, several international companies have set up operations in Luxembourg. This includes Japanese startup Thermalytica, South Korean Vsion, US company Pony.ai among others.

In Europe, the primary sectors driving FDI are: software & IT services (17%), business services & professional Services (10%), transportation & logistics (8%), transportation manufacturers & suppliers (8%), machinery & equipment (7%).

Focus on high-tech sectors and innovation, SMEs

To preserve Luxembourg’s competitive advantage, executives recommend increased focus on innovation and high-tech sectors like cleantech or healthcare, SMEs, education and skills, and access to talent. The latter is described as the biggest risk to competitiveness for the financial and industrial sectors. Employment agency ADEM outlined in a recent interview its strategies for helping companies find the best candidates and the impact of a new immigration law in facilitating recruitment.

EY recommends that Luxembourg continue to grow as an investment fund hub and as a testing ground for Industry 4.0, R&D activities, and startups.

“Our job as the national innovation agency has been to support companies individually with their innovation projects,” mentions Sasha Baillie CEO of Luxinnovation. “To help them get access not only to finance, but also to knowledge, by connecting them with research institutes to help them really structure their projects in a manner that would be able to be render the companies competitive.” She also underscored Luxembourg’s growing startup ecosystem and different measures to support growing companies, like the new scaleup support programme and the upcoming Luxembourg Venture Days. The latter serves as a convergence point for investors and startups in Luxembourg.

The report highlights Luxembourg’s success as a “space nation” and suggests emulating efforts in the defence and security sectors. It also recommends focusing on pragmatic tax policies and addressing talent-related concerns.

“I feel the momentum is great for Luxembourg to emerge as a safe place in Europe to do business. More than ever, foreign direct investors will search for places which can provide a stable environment, so the timing of the survey is perfect to know where we are today and what needs to be adjusted,” underscores Mr Coekelbergs.

Photo credit: Unsplash/Johny Goerend